Pegatinas de banderas nacionales para juguetes, Mapa de países, pegatinas impermeables de viaje para manualidades, álbum de recortes, Maleta, portátil, coche y motocicleta, 50 unidades - AliExpress

Ilustración de Pegatinas De Varios Países Regalos De Viajeros y más Vectores Libres de Derechos de Torre de Pisa - Torre de Pisa, Vector, 2015 - iStock

Toyvian 7 Hojas De Pegatinas De Banderas Mundo Pegatinas Pegatinas De Países Pegatinas De Banderas De Países Pegatinas De Viaje Para La Escuela Diario Álbum De Recortes : Amazon.es: Oficina y papelería

lote 10 antiguas pegatinas seat paises europeos - Buy Antique and collectible stickers on todocoleccion

Pegatinas Paises Ciudades Pegatinas Maletas Viaje equipajes Bolsas Pegatinas vinilos Viajes Scrapbooking laptops macbook portatil vscol Stickers Travel Pegatinas de Turismo Paise del Mundo : Amazon.es: Juguetes y juegos

Pegatinas de Mapa de países para niños, 50 unidades, pegatinas de viaje para DIY, álbum de recortes, Maleta, portátil, coche, motocicleta, banderas nacionales, Juguetes - AliExpress

Vintage pegatinas paises sellos retro maletas viaje stickers scrapbooking viajes pegatina vintage equpaje portatil diario de viajes cuaderno calendario : Amazon.es: Oficina y papelería

Pegatinas banderas nacionales paises mapa pegatina viajes vinilos portatil equipaje maletas botella de agua coche bandera España : Amazon.es: Coche y moto

Pegatinas banderas nacionales paises mapa pegatina viajes vinilos portatil equipaje maletas botella de agua coche bandera España : Amazon.es: Coche y moto

200 PCS Paises Ciudades Pegatinas Maletas Viaje Equipajes Bolsas Pegatinas Viajes Portatil Stickers Travel Pegatinas de Turismo Paise del Mundo : Amazon.es: Hogar y cocina

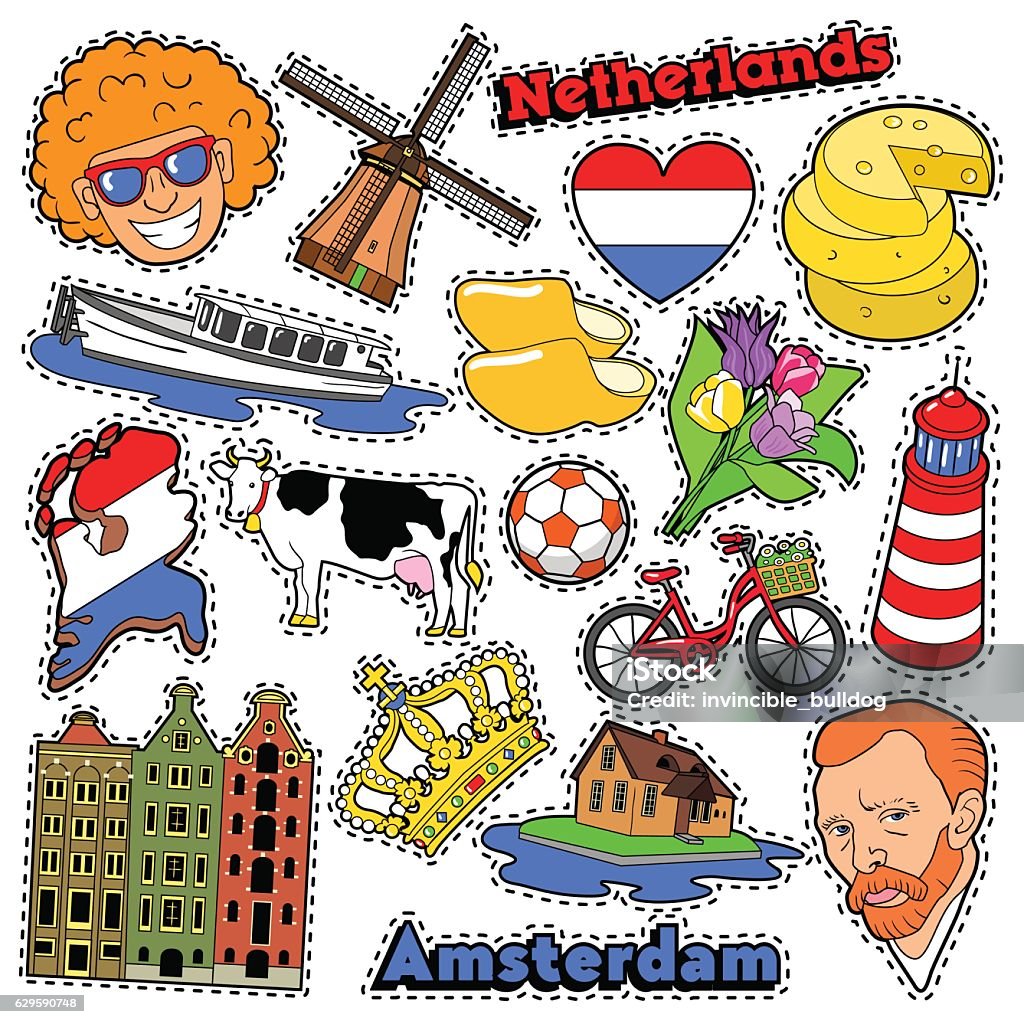

Ilustración de Países Bajos Pegatinas De Viaje Parches Insignias y más Vectores Libres de Derechos de Países Bajos - iStock

Resultado de imagen de pegatinas de paises para maletas | Imprimibles viajes, Manualidades, Imprimibles vintage

Pegatinas de la bandera de nepal países bajos nueva zelanda níger nigeria corea del norte macedonia del norte noruega | Vector Premium